How Much Do Credit Unions Spend per Year on Social Media?

Credit union social media budget and credit union social media spending tell a lot about the success of credit unions. Currently, there are over 46,000 credit unions and over 172 million members. Perhaps you’re wondering how much do credit unions spend per year on social media. Let’s find out.

Nov 14 2019 ● 9 min read

People who are familiar with each other, who are officially or socially connected on common grounds, tend to form organizations to assist each other. These organizations are cooperative associations or, rather, financial institutions called credit unions.

Members of this organization can be from the same society, office, college, or even public service as long as there is a mutual connection. This practice became prevalent in recent times, with nearly 90 million Americans directly involved with more than $615 billion in savings.

So How Much Do Credit Unions Spend On Social Media?

At least three times per year, a credit union member walks into a physical branch on an average. Marketing and advertising strategies have been reformed concerning the change in the banking habits of consumers.

This brewing issue brought forth social media marketing, so, therefore, we ask how much do these credit unions spend to use social media as a strategy for marketing. To keep up to date with the trend, traditional/local services will have to embrace this style of marketing to stay in the market.

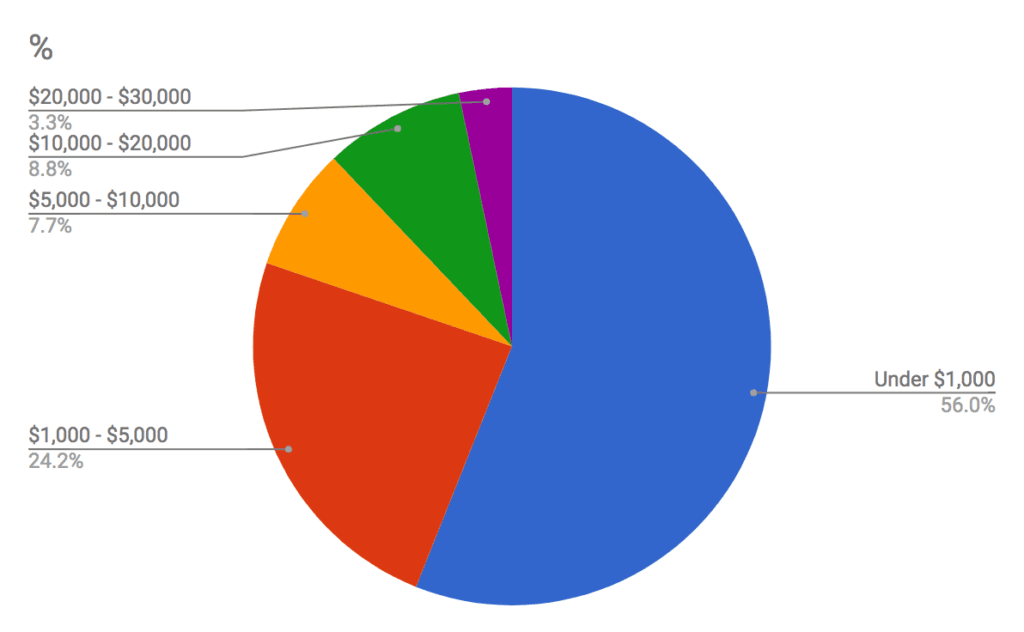

During a survey, it was found that credit unions (56%) spend below $1000 annually on social media platforms to improve results in mid-2017. However, 38% were optimistic about the effects of social media marketing and stated that efforts to increase its use would be in play, while 53.8% showed no interest.

|

Year after year, credit unions are faced with pressure to increase the market and book yield. At the change in civilization, consumer behavior is also changing, and traditional marketers are gradually declining in results. This one makes it essential to know just how much credit unions spend on marketing.

An analysis by the financial brand showed the marketing budgets for the 100 most prominent credit union organization in the U.S. This data was drafted from marketing expenditures declared by NCUA in July 2014.

So How Much Do Credit Unions Spend Per Year On Social Media?

This analysis showed that credit unions spent an average of $8-16$ per associate on marketing. With the median at $12.52. Having about 24,448 associates, the $2 billion institutions has a marketing budget of $5,8 million and looking forward to attaining a whopping $236.51 per associate.

This target was made by Melrose, spending most of their members with $200 more than the next credit union organization on the list. Bethpage seconds that list with $34.77 per associate.

How Much Capital Is Required To Kick Start A Credit Union Organization?

Most credit unions start with grants and donations to cover up the finances for a startup from PFCU. Typically, a credit union will experience losses at the start till it accumulates enough traffic. These contributions and grants cover these losses until an adequate profit stance is met. The amount of capital is not fixed as it is dependent on PFCU'S initial services.

From structure to model, the overall services equate to excessive money being pumped into it, and the actual amount is determined by the Pro-forma financial statements and financial plans for independent operation. An estimate lies between $300,000 and $100,000 per $1 million in projected assets. As a core example, to achieve $5 million in assets at the end of the fifth year, a $500,000 in commitments should be acquired as capital. This is not excluding the possibility of additional funding.

A booklet on this topic published by the NCUA is directly concerned with credit union startups bit this depends on if a primary or full-service credit union. The costs to pre-charter spread from $50-150k and post chartering at $50-350k — this book provides an idea about in-depth resources in terms of knowledge to be correctly insured.

Where Do Credit Unions Lay Their Investments?

The profit gained by credit unions is most times re-invested to yield a higher return. Every associate invests a minimum set amount into the credit union, and in turn, the credit union re-invests this funds to generate a higher return for its members. The generality of the members determines the method at which this fund is financed and loaned out. This yields more for both the credit unions and it's members. The loans given out to members vary based on their previous history with the credit union and savings account. The funds are also out into bonds and currency, even as an investment method.

How Much Do Banks Spend On Marketing?

An analysis by EMI in 2018 on 27 leading banks in the United States was carried out. It was found that the majority of these banks invested majorly in marketing. The economic growth can be wisely traced back to banking and finance strategies. The investment by brands helps to ensure brand awareness. Cost savings acquired from smaller branch networks are reinforced to other features of marketing.

Banks spend an average of 0.0828% of assets on marketing. With a median of 0.1218% on being average marketing budget scaling $2.1 million per bank and a median of $437,000. These scales cover from paper statements to marketing employees and advertisement strategies, both online and offline.

Conclusion

Run by Mark Zuckerberg, Facebook stands as a significant strategic player with about 87% of k stations and brands actively marketing on this platform. A data correlation showed that Facebook stands as the platform king with a regular succession between the number of years active on this platform and the presence attained by these institutions.

With facts and figures backed up by Kasasa, the majority of community banks and credit union organizations invest more than $1000 annually on social media marketing awareness.

Published on Nov 14 2019

WRITTEN BY

Gintaras BaltusevičiusGintaras is an experienced marketing professional who is always eager to explore the most up-to-date issues in data marketing. Having worked as an SEO manager at several companies, he's a valuable addition to the Whatagraph writers' pool.