Top 9 Agency Metrics and KPIs to Track and Improve

Metrics are essential in optimizing marketing agency performance because they provide a clear understanding of how well strategies and campaigns are performing. They give senior executives the data they need to make informed decisions, help agencies reach specific goals, and demonstrate value to their clients.

By regularly monitoring metrics, agencies can identify slow performance areas and use insights to make data-driven adjustments.

Senior agency executives can leverage metrics to set clear objectives, identify marketing agency KPIs, optimize resource spending, and predict future market trends.

This guide provides a comprehensive agency metrics checklist to help agency owners maximize the usefulness of the vast amounts of data they collect daily.

Aug 27 2024●12 min read

Why are marketing agency metrics important?

Metrics play an important role in evaluating how well a marketing agency's strategies are performing. They provide measurable insights that allow agency leadership to understand the impact of their actions, make necessary adjustments, and optimize future campaigns.

Here are five ways in which marketing agency KPIs contribute to these assessments:

1. Measure campaign performance

Metrics like conversion rate, ROAS, and click-through rate (CTR) help agencies evaluate the success of individual campaigns. For example, a high conversion rate shows that the marketing message resonates with the target audience and effectively drives desired actions, such as purchases or sign-ups. On the other hand, a low ROAS might be a signal that a campaign is not driving sufficient revenue to justify its cost.

2. Evaluate customer engagement

Agency performance metrics related to customer engagement, such as engagement rate, net promoter score (NPS), and customer lifetime value (CLTV), allow agencies to measure client satisfaction and loyalty. For example, a high NPS suggests that clients are happy with the service and likely to recommend the agency, while a low NPS may indicate issues that need addressing to prevent churn. CLTV, on the other hand, helps agencies understand the long-term value of each client and take steps to maximize customer retention and profitability.

3. Optimize marketing channels

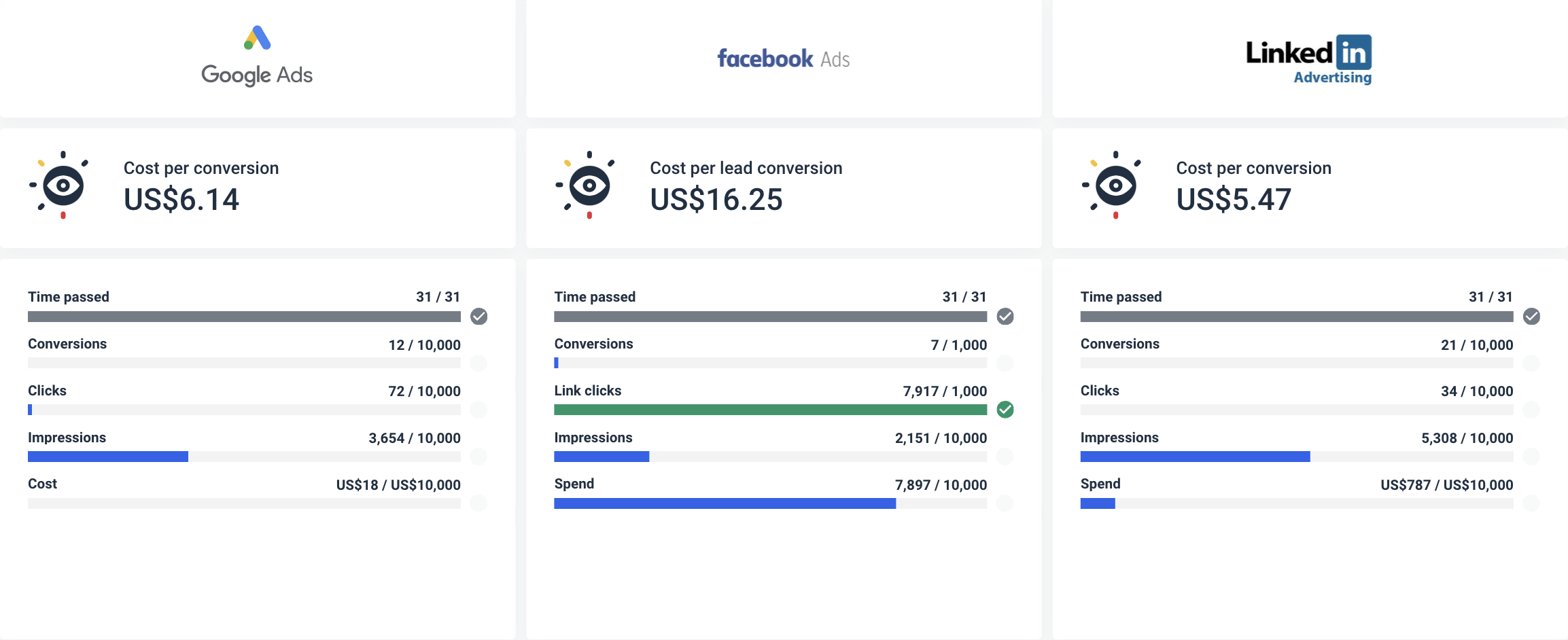

By tracking channel-specific metrics like cost-pre-acquisition (CPA) and ROI of each channel, agencies can discover which marketing channels (e.g., social media, PPC, SEO) are most effective. This allows you to make more informed decisions about where to allocate resources. For example, if PPC ads have a lower CPA and higher ROI than social media campaigns, you may consider shifting more of your budget towards PPC.

4. Identify areas for improvement

Marketing agency KPIs such as bounce rate, churn rate, and time on page help agencies identify bottlenecks in the user journey. A high bounce rate might suggest that the landing page content is not interesting or relevant, while a low time on page could indicate that visitors can’t find the information they need. Addressing these issues can considerably improve the effectiveness of your marketing strategies.

5. Track financial health

Financial metrics like gross margin, operating profit margin, and revenue growth rate help agencies assess the overall health of their marketing strategies from the profitability perspective. For example, gross margin indicates the efficiency of service delivery, while operating profit margin reflects the agency's ability to manage its costs in relation to its revenue. Monitoring these marketing agency KPIs ensures that the agency remains financially viable as it executes marketing strategies for its clients.

Top 9 marketing agency KPIs you should track

Let’s now round up the essential marketing agency metrics that should always be in your rearview.

Client acquisition metrics

- Cost per acquisition (CPA)

- Customer lifetime value (CLTV) (also CLV)

Client retention metrics

- Net promoter score (NPS)

- Churn rate

Campaign performance metrics

- Return on ad spend (ROAS)

- Conversion rate

Financial metrics

- Gross margin

- Operating profit margin

- Utilization rate

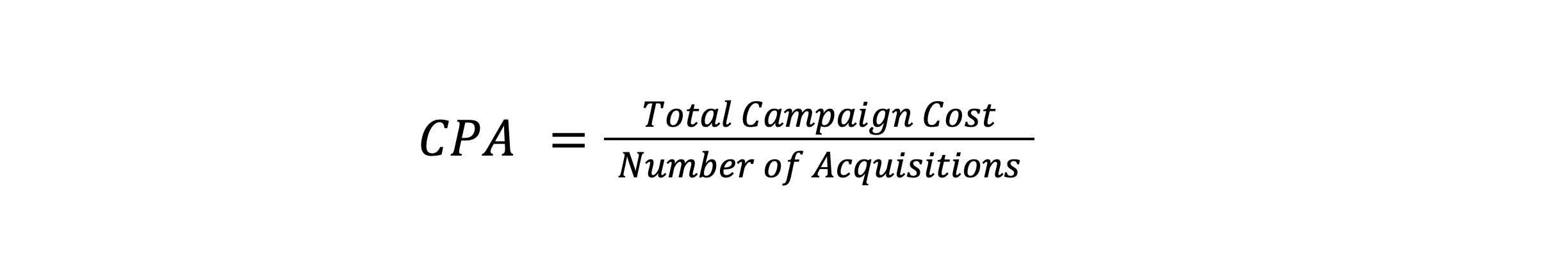

1. Cost per acquisition (CPA)

CPA is a metric that represents the total cost of acquiring a customer or lead through a specific marketing campaign. It is calculated by dividing the total campaign costs by the number of conversions (acquisitions) that resulted from that campaign.

This is a critical marketing agency metric for several reasons:

Performance measurement: CPA is a clear indicator of how cost-effective a marketing campaign is in converting potential leads into paying customers. A lower CPA might be a sign that the campaign is efficiently converting leads, while a higher CPA may suggest that the campaign is either too costly or not effectively targeted.

Budget allocation: By understanding the CPA for different campaigns or channels, agencies can distribute their funds more effectively. For example, you can scale up campaigns with a lower CPA and re-evaluate or pause those with a higher CPA.

Pricing strategy: CPA helps agencies determine the profitability of their marketing efforts. By identifying the average CPA, you can set appropriate pricing for your services, ensuring you cover your costs while delivering value to clients.

Client reporting: Agencies can use CPA to demonstrate the value of their services to clients. By showing how efficiently they can acquire customers, agencies build trust and justify their strategies and costs.

ROI calculation: CPA is directly tied to ROI (Return on Investment). A campaign with a lower CPA generally yields a higher ROI — the ultimate goal for both agencies and their clients.

How can marketing agencies can optimize CPA for better ROI?

Optimizing CPA is essential for maximizing ROI. Here are some strategies that marketing agencies can use:

- Adjust targeting strategies: By narrowing down the audience to those most likely to convert, agencies can reduce wasting ad spend on uninterested users, effectively lowering CPA. This could involve targeting by demographics, behaviors, interests, or even specific geolocations. Use precise targeting options in digital advertising platforms to reach the most relevant audience.

- A/B testing campaign elements: A/B testing helps identify which campaign variations perform best. By implementing the most effective versions, you can increase conversion rates, which leads to reduced CPA. Continuously test different campaign elements, such as ad copy, images, calls-to-action (CTAs), and landing pages.

- Improving landing page UI: A well-optimized landing page that is directly aligned with the ad’s message can significantly boost conversion rates. This can reduce the number of visitors needed to achieve the same number of conversions, lowering CPA. Optimize landing pages to ensure they are relevant, user-friendly, and load fast.

- Launch retargeting campaigns: Retargeting can often lead to higher conversion rates because it focuses on an already warm audience. These campaigns generally have a lower CPA compared to acquiring entirely new leads. Implement retargeting strategies to re-engage users who have shown interest but did not convert.

- Ad spend optimization: Analyzing this advertising agency metric across different channels allows you to shift budgets towards those that regularly deliver lower CPAs, thereby optimizing overall campaign efficiency. Allocate more budget to high-performing channels and reduce spend on underperforming ones.

- Consider automated bidding: Automated bidding relies on machine learning to adjust bids in real time. The goal here is to get the most conversions at the lowest cost and help agencies achieve a more favorable CPA. Use automated bidding strategies offered by platforms like Google Ads to optimize bids for conversions.

- Focusing on high-intent keywords: When you target high-intent keywords such as terms with “best”, “top”, “pricing”, or “comparison”, you tend to attract more qualified leads who are ready to convert, which leads to lower CPA.

- Analyzing competitor strategies: You should also monitor and analyze competitor campaigns to understand what’s working for them. By identifying successful strategies used by competitors, your agency can adapt and apply similar tactics to your own campaigns, potentially lowering your CPA.

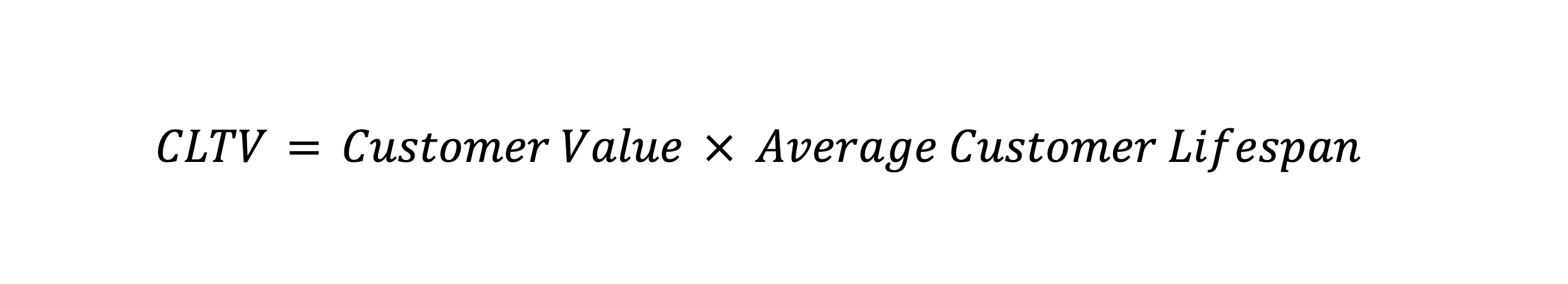

2. Customer lifetime value (CLTV)

CLTV represents the total revenue a business can expect from a customer over the entire duration of their relationship. For marketing agencies, understanding CLTV is important because it provides insights into the long-term value of their clients, allowing them to develop strategies that maximize profitability and client retention.

Client value is calculated by multiplying the average purchase value and the average number of purchases.

Customer lifetime value is an essential marketing agency metric because it helps you:

Make informed decisions on client acquisition: When you know the CLTV of different clients, you can decide how much to spend on acquiring new clients. For example, if you know that the CLTV of a particular client segment is high, you can justify the higher CPA for acquiring those clients, as the long-term returns will probably outweigh the initial costs.

Optimize client retention strategies: CLTV is a metric closely related to nurturing client relationships. By understanding a client's long-term value, you can focus on strategies that improve client satisfaction and loyalty, which in turn increases CLTV. This is especially important when we know that retaining a client usually costs less than acquiring a new one. For example, you can develop tailored retention programs for high-CLTV clients. These can include personalized communication and special offers that increase the chances they'll renew contracts or purchase additional services.

Invest time in understanding their unique needs, setting clear expectations, and providing tailored solutions that prioritize long-term growth. Consistently communicate, educate, and demonstrate - your value is in what you do, not what you say.

Predict your revenue: Knowing CLTV can help you forecast future revenue more accurately, which is essential for your agency’s financial planning and growth strategies. A higher average CLTV promises a stable revenue stream, which supports long-term financial health and allows for better resource allocation. For example, if you know the average CLTV of your clients, you can predict future cash flows and make informed decisions about investing in new services, hiring staff, or expanding your operations.

Identifying opportunities for upselling: CLTV also helps agencies identify clients with the potential for upselling or cross-selling additional services. For example, if you identify a long-term client that uses only basic services, your sales team can pitch additional services to meet their evolving needs, such as advanced analytics or a new campaign management tool.

How can marketing agencies increase CLTV?

Increasing CLTV requires a strategic approach that involves improving client relationships, delivering consistent value, and encouraging long-term engagement. Here are some effective strategies:

- Act on client feedback: Regularly ask for client feedback and make improvements based on their input. Direct feedback or surveys can help you better understand client satisfaction levels and address their concerns before they escalate. For example, post-project surveys, which measure client satisfaction and make adjustments based on their feedback, show clients that their opinions are valued, which leads to a higher retention rate. Find more ways to improve client satisfaction in our guide on how to exceed client expectations as a marketing agency.

- Deliver exceptional client service: Start by providing excellent customer support and establish proactive communication to make sure clients are valued and heard. Regular check-ins, personalized service, and timely resolution of issues build trust and loyalty, which significantly improve client satisfaction and retention. As an extra step, you can assign a dedicated account manager for high-value clients. This way, they can receive personalized attention and swift responses to their needs, increasing their likelihood of renewing contracts.

- Offer customized solutions: You should tailor services and marketing strategies to meet each client's specific needs. This should be the rule for all your clients, as each business has unique challenges and goals. This customization not only helps in achieving better results but also strengthens the client’s dependency on the agency. For example, if a client is struggling with social media engagement, you could develop a targeted social media strategy that addresses their specific audience, increasing their satisfaction and encouraging a long-term partnership.

However, to be able to offer customized experiences to your clients often requires you as an agency to upgrade to more flexible solutions as well.

For example, as your client grows and asks you to track more and more marketing channels, the existing performance reporting solution might be too slow and inefficient to provide them with the kind of insights they need.

This is often the case for agencies using free reporting tools like Looker Studio. As they scale to meet their clients’ evolving needs, at one point, they might feel as if they have outgrown Looker Studio and start looking for more customizable solutions.

3. Net promoter score (NPS)

Net promoter score is one of the widely used creative agency KPIs that measure the chance of clients recommending a company’s products or services to others. It is a key indicator of client satisfaction and loyalty that tells you how clients perceive the agency and their overall experience.

How does NPS work?

NPS is typically measured by asking clients a single question: “On a scale of 0 to 10, how likely are you to recommend our services to a friend or colleague?”

Scoring:

- Promoters (9-10): Clients who are highly satisfied and loyal, likely to recommend the agency.

- Passives (7-8): Clients who are satisfied but not enthusiastic enough to actively promote the agency.

- Detractors (0-6): Clients who are dissatisfied and may harm the agency’s reputation through negative word-of-mouth.

The score ranges from -100 to +100, with higher scores indicating better client satisfaction and loyalty.

NPS is a significant metric for marketing agencies for a number of reasons. It provides insight into:

Client satisfaction: NPS provides a straightforward way to measure overall client satisfaction. A high NPS shows that clients are pleased with the agency’s services and are likely to remain loyal.

Growth predictions: Agencies with high NPS scores are more likely to experience growth through client referrals and positive word-of-mouth. On the other hand, a low NPS can signal potential issues that may lead to client churn.

Benchmarking your performance: NPS allows agencies to benchmark their performance against competitors or industry standards, providing context for their client satisfaction levels.

What are the best practices for improving NPS in an agency?

Improving NPS includes increasing client satisfaction and loyalty by addressing the factors that affect their perception of the agency. Here are some best practices:

- Deliver consistent service: When clients know they can count on the agency to deliver high-quality results every time, their satisfaction and loyalty increase, which leads to higher NPS scores. You can ensure that the quality of your agency service is consistent across all client interactions by standardizing your processes and maintaining regular communication to ensure that clients receive the same level of service regardless of the project or team member involved.

Physically meet with any new marketing person immediately. A new hire is the biggest risk of losing a client. Not because an agency is doing a bad job but frequently one of the only levers a digital marketing manager can pull is to change agency. Building a level of rapport as fast as possible helps client to know what the agency people are like and the agency can understand the new hire's thought process.

- Improve communication and transparency: Clients appreciate transparency and updates. Keeping them informed helps manage expectations and build trust, which is essential for improving NPS. Consider providing monthly performance reports and holding regular strategy sessions with clients to ensure they are always in the loop.

- Launch a client success program: A client success program proactively supports clients in reaching their objectives and ensures they get maximum value from your agency’s services. This can significantly increase client satisfaction and their likelihood to recommend the agency. Start by assigning a client success manager to each client, who regularly checks in on their progress and offers strategic advice.

- Quickly address and resolve issues: The speed and dedication with which you resolve issues can turn a negative experience into a positive one, potentially converting detractors into promoters. A quick response shows clients that the agency cares about their satisfaction. One strategy is to establish a rapid response team to handle client issues and provide solutions within a short time frame.

4. Churn rate

The churn rate is the percentage of clients who stop using a service over a specific period. For a marketing agency, a high churn rate is a sign that a significant number of clients are not satisfied or finding better alternatives elsewhere. It is essential that you monitor the churn rate regularly, as it directly impacts your revenue and growth potential.

This customer satisfaction metric is closely related to customer lifetime value and customer acquisition cost (CAC). By comparing CLTV against churn rates, your agency can estimate if you are maximizing the potential value from your clients. On the other hand, if both CAC and churn rates are high, your agency might be spending more on acquiring clients than they are worth over time. This is a signal to improve retention efforts.

Monthly/annual recurring revenue (MRR/ARR) are key financial health metrics that you should also track in relation to churn to understand the financial impact of losing your clients.

How to analyze churn rate?

- Cohort analysis — In this technique, you group clients based on shared characteristics, such as start date, and track their behavior over time. By analyzing these groups, you can identify trends in client retention and predict when and why clients are most likely to churn.

- Customer feedback — Collecting qualitative data through surveys allows you to understand the specific reasons behind client churn in your agency. Feedback can point out areas where your services may fall short of client expectations.

- Churn prediction models — Predictive analytics and machine learning can help you develop models that forecast which clients are at risk of churning. These models analyze patterns in client behavior and engagement to identify early warning signs.

What strategies can marketing agencies use to reduce churn rate?

By analyzing churn rate and implementing these targeted strategies, marketing agencies can significantly improve client retention and build more stable and lasting relationships.

- Improve client onboarding: During onboarding, you should define goals, deliverables, and timelines. This helps avoid misunderstanding and ensures that clients know what to expect. You should tailor the onboarding process to each client so that you can make them feel valued and understood, again reducing the chances of early churn.

- Consistent communication and reporting: Regular communication is a factor that repeats over and over. Regular reports about the progress of their campaigns can help clients see the value of your agency’s work. However, consistent reporting doesn’t mean you have to spend hours each week to get all the reports ready in time. If you choose the best reporting solution for your agency, you can automate most of the reporting tasks and use time on higher-value tasks.

- Offer value-added services: Introducing clients to additional services that complement their existing package can increase the relationship and their investment in the agency. When you provide customized strategies that meet each client’s specific goals, you make your agency’s services more indispensable, reducing the risk of churn.

- Identify and address high-risk clients early: By monitoring client behavior, you can set up a system that flags clients who show signs of dissatisfaction or low engagement. This allows you to react early. For example, you can reach out to high-risk clients with special offers, additional support, or a review of their accounts to address any issues before they lead to churn.

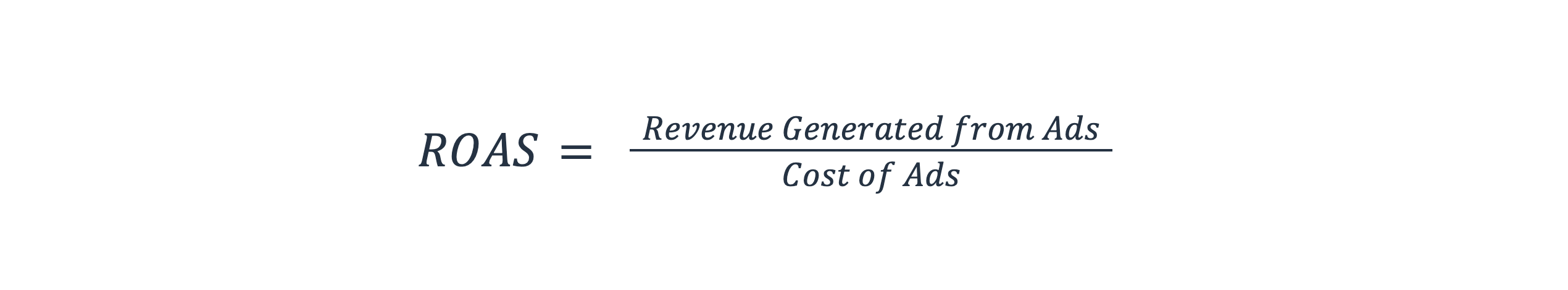

5. Return on ad spend (ROAS)

ROAS is a key metric used by digital marketing agencies to evaluate the effectiveness of their advertising campaigns. It measures the revenue generated for every dollar spent on advertising. A higher ROAS is a sign of a more successful campaign, as it shows that the agency is generating more considerable revenue in relation to its ad spend.

This advertising agency metric is essential for determining whether your advertising efforts are yielding a positive return if you need to adjust something to optimize performance. However, unlike CTR or CPC, which focus on user engagement, ROAS is directly tied to the project profitability, which makes it a more comprehensive KPI.

How to calculate ROAS:

How can ROAS help you optimize your campaign?

Budget allocation: This agency performance metric helps your agency determine how to distribute its budget. Campaigns with higher ROAS should receive more investment, while those with lower ROAS may need adjustments or simply reduction in spend.

Performance benchmarking: You can use ROAS to compare the effectiveness of different campaigns, channels, or strategies to identify high-performing models and replicate their success in other projects.

Client reporting: ROAS is a straightforward metric you can present to clients, as it directly links ad spend and revenue. Clients can easily see the financial return on their investment, which builds trust and transparency in the agency-client relationship. The easiest way to streamline presenting key performance metrics to clients is to use our client dashboard software. You can use it to compare ROAS across different ad platforms and identify which channel brings the most leads and which needs to be optimized.

How can agencies analyze and improve ROAS?

By analyzing and optimizing ROAS, marketing teams can ultimately drive greater profitability for both the agency and its clients.

- Track conversion and attribution: Make sure conversion tracking is set up accurately across all ad platforms. Use tools like Google Analytics 4, Facebook Pixel, or native platform tracking codes to monitor your ad performance. Multi-touch attribution models can help you understand the customer journey. This can help you accurately attribute revenue to the correct ad or campaign instead of giving all credit to the last touchpoint.

- Improve ad relevance: Segment your audience based on demographics, interests, and behavior. Tailored messaging to specific segments can increase engagement and conversion rates, eventually improving ROAS. Develop ad creatives that are in line with each audience segment to boost ad performance and higher revenue.

- Analyze based on data: Monitor ROAS across campaigns and make data driven decisions to adjust strategies. Identify low-performing ads or channels and optimize or redirect resources based on your findings. Compare ROAS across search engines, social, display ads, etc. to spot the most profitable platforms and direct your efforts there. For example, if you see that a campaign is performing well in a specific demographic or region, expand the targeting to similar groups or localities to replicate success.

6. Conversion rate

Conversion rate for marketing agencies is a key performance indicator that reflects the percentage of users that take a desired action on the website, such as make a purchase, sign up for a newsletter, after interacting with an ad or landing page. It is a clear indicator of how well your campaign is performing. A higher conversion rate usually means that the campaign is resonating with the target audience and driving meaningful results.

Why is conversion rate important for agencies?

Optimizing ROI: Conversion rate is directly tied to return of investment (ROI). Even if a campaign has a high CTR, it’s only successful if those clicks convert into actions that are in line with the campaign goals. By focusing on conversion rates, you can ensure that your ad spend is generating positive outcomes and a better ROI.

Assessing audience behavior: Conversion rates can tell you how well an ad or landing page meets the interests of the audience. If users are clicking on ads but don’t convert, it might be a sign that the ad and landing page messaging is mismatched or that the proposition is not compelling enough. Tracking this can help your agency fine-tune its messaging and offer to better meet user intent. Analyzing conversion rates at different stages of the customer journey can help you identify where users drop off. This allows you to zoom down to specific areas that need improvement — ad copy, landing page design, or checkout process.

What techniques can agencies use to improve conversion rates?

Employing these conversion rate boosting techniques, agencies can maximize their own ROI:

- Optimize landing pages: It goes without saying that the landing page content should align closely with the ad copy. Consistency in messaging reinforces user intent and motivates them to take the desired action. You should also look to simplify the user experience by removing any unnecessary elements that might distract or confuse users. A clean intuitive design with clear calls-to-action (CTAs) will help guide users towards conversion.

Your CTAs should be persuasive and impactful. Use actionable phrases that clearly communicate what the user will gain by clicking the button, such as “Book a Demo” instead of “See Whatagraph in Action”.

- Improve page loading speed: Pages that load slowly can significantly reduce conversion rates, as users are more likely to abandon the site. Optimize images, use efficient coding practices, and content delivery networks to ensure fast loading times. Also, make sure the landing pages are optimized for mobile devices. As more and more users access content on their phones. A mobile-friendly experience is essential for keeping conversion rates high.

- Use social proof and trust signals: Display customer testimonials, reviews, or case studies on landing pages to build trust and credibility. When they see that others have had positive experiences, potential clients will be more likely to take action. If you are optimizing an e-commerce site or a page where users enter personal information, include security badges like SSL certification and payment protection badges to reassure users their data is safe.

- Streamline registration and checkout flows: Only ask for essential information in registration forms. Complex forms can demotivate users from completing them. Make your forms as simple as possible for a higher subscription rate. In case of e-commerce sites, offer a guest checkout option to reduce complexity for first-time buyers.

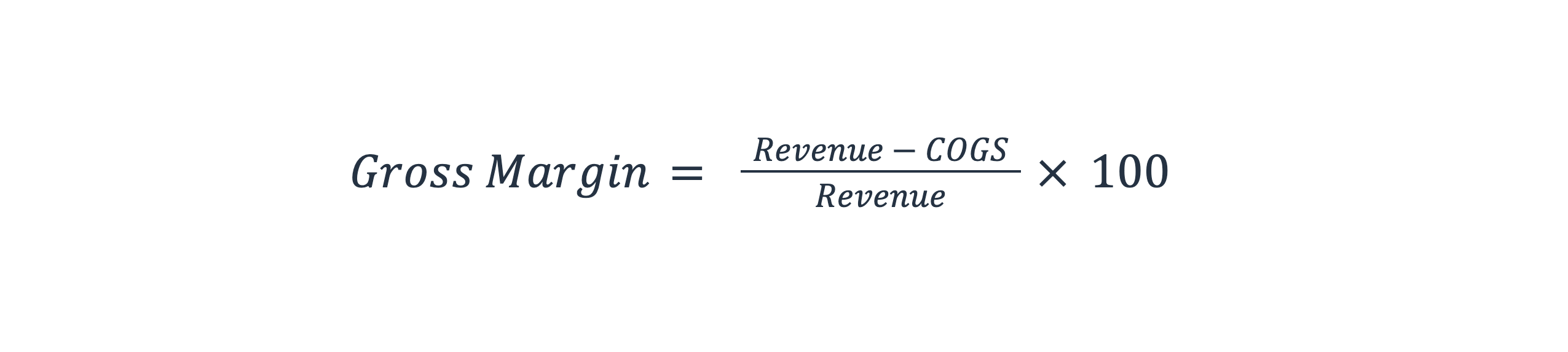

7. Gross margin

Gross margin is the difference between a company’s revenue and the cost of goods sold (COGS). For a marketing agency, COGS includes direct costs such as employee salaries, subcontractor fees, software, and any other expense tied directly to delivering client services.

How to calculate gross margin:

Gross margin is an important indicator of your agency’s profitability because it shows how efficiently you manage your direct costs in relation to the revenue generated. A higher gross margin shows that the agency retains more revenue after converting the cost of delivered service, which can be used to cover overhead expenses, invest in growth, and generate profit.

You can use this metric to assess how well your agency manages its resources but also to inform your pricing strategy. If the gross margin is low, you may need to reassess your pricing model — either by increasing prices or reducing costs to ensure long-term profitability.

Regularly monitoring gross margin helps agencies understand their financial health. It gives you insight into how much revenue is available to cover other operating costs and contribute to net profit.

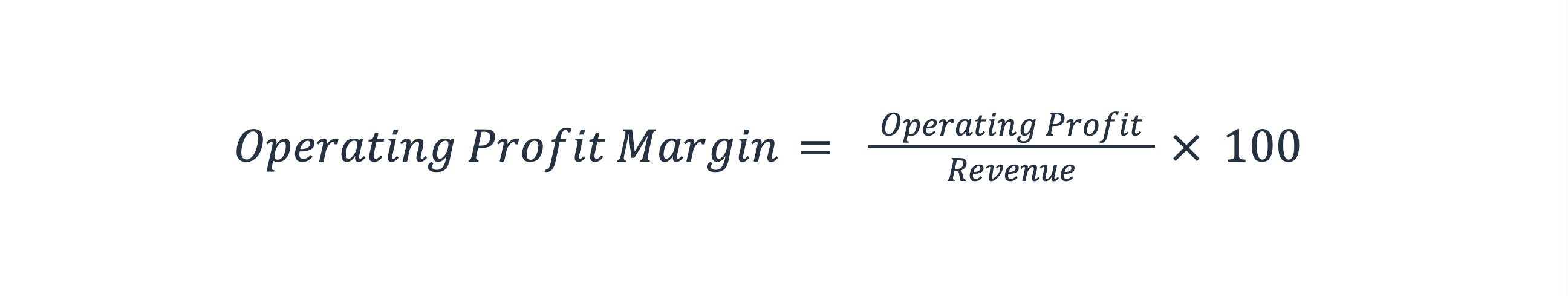

8. Operating profit margin

Operating profit margin is a financial metric that measures the percentage of revenue that remains after all operating expenses are taken from gross profit. These operating expenses include costs like salaries, rent, utilities, marketing and administrative costs, but don’t include interest and taxes.

How to calculate the operating profit margin?

This marketing agency KPI provides a clear idea of how efficiently a marketing agency manages its overall operations. It presents the agency’s ability to convert revenue into profit after accounting for the essential costs of running the business.

A strong operating profit margin provides the financial stability that is necessary for reinvesting into the agency’s growth, such as expanding services, hiring talent, or exploring new markets.

What are the tactics to increase gross and operating profit margin?

By taking steps to increase gross margin, you can improve your agency’s profitability, ensure long-term sustainability, and create more value for both your clients and their business.

- Optimize workforce efficiency: Use project management tools to improve task management, time tracking, and resource allocation. This way, you can ensure that projects are completed more efficiently. Regular employee training can improve their skills, which leads to higher quality work and faster completion. Consider outsourcing non-core tasks to specialized agencies or contractors. Sometimes, this is more cost-effective than hiring full-time people for certain roles.

- Reduce direct costs: Negotiate with vendors for better rates for your essential tools and software. Discounts or bulk pricing can reduce COGS and improve your gross margin. You should also invest in automation tools that eliminate the need for manual work. For example, using an automated reporting tool can reduce time spent on creating client reports, allowing your account managers to focus on higher-value activities. If you want to upgrade your agency’s reporting tool but are not sure what to look for, check out our marketing reporting software.

- Improve pricing strategies: Consider moving from cost-plus pricing (where a fixed markup is added to costs) to value-based pricing, where prices are set based on the delivered value to the client. This allows you to charge premium rates for high-value services and increase gross margin. You should also offer tiered service packages that meet the needs of different clients and budgets. This way, you can capture more revenue from clients who are willing to pay for higher-value services.

- Specialize in high-margin services: When you focus on niche markets or types of service, you have an opportunity to charge premium rates, as clients are often willing to pay more for expertise. Develop unique tools of processes that deliver superior results or efficiency to justify higher pricing. These specialized offerings can differentiate the agency in the market and increase gross margins.

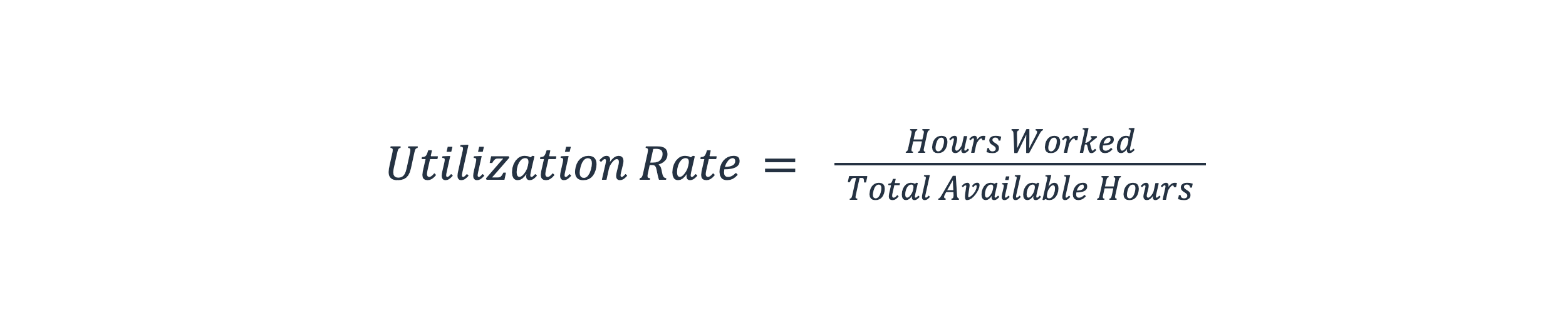

9. Utilization rate

Utilization rate is one of the essential agency metrics which tells you how much of your employee’s available time is spent on billable work. If this rate is too high, you may need to add more resources, while the low rate means you’re not bringing in enough work.

For marketing agencies, as for any service business, time is the limiting factor. No matter how effective your business model is, you have 24 hours in a day. Take from this sick leaves, vacation time, and public holidays, and most agencies get between 1600 and 1800 working hours each year.

However, not all of these hours are billable. You also need to account for training, team building time, pro bono work, business development and all other activities that make up so-called non-billable hours.

Utilization rate is a measure of how much of this available time is used for productive work and is calculated as:

While being a simple metric, the utilization rate gives you plenty of insight into your agency’s profitability and productivity. Let’s list a few:

- A consistently high utilization rate means your resources are overworked.

- A large gap between utilization and realization rates means your employees are spending much time on non-billable tasks.

- Tracking utilization for each skill and employee role can help you plan hiring.

- Tracking utilization rate by skill shows whether you are in demand for certain roles.

- A utilization rate above 100% implies poor planning and a lot of work out of scope.

Read more about how utilization rate affects your profitability and how to increase this metric in your agency in a separate article.

Tools and software for tracking marketing agency metrics

Google Analytics 4

Google Analytics 4 can help agencies track where new clients are coming from, which channels are most effective (organic search, paid ads, social media), and which marketing campaigns drive the most conversions. It can provide detailed reports on user behavior, conversion paths, and multi-channel funnels that show how users move through the acquisition process.

You can use it to track user behavior over time, helping agencies monitor returning visitors, engagement rates, and the effectiveness of content. It also allows you to segment users based on behavior, which is essential for a better understanding of retention trends.

Google Analytics 4 can also help your agency track various campaign performance metrics, such as CTR, conversion rates, bounce rates, and digital campaign ROI. It can give you a clear picture of how campaigns are performing across different channels and audience segments.

Tracking financial metrics is possible with Google Analytics 4 as well, indirectly through e-commerce tracking and goal conversions. This gives you insights into revenue generated by specific campaigns, average order value, and ROI.

HubSpot

HubSpot offers comprehensive CRM and marketing tools that help you track client acquisition from lead generation to conversion. You can use it to monitor the entire customer journey, including the source of leads, content interactions, and conversion rates. HubSpot's integrated CRM system automatically tracks and logs all interactions with potential clients, which reduces manual efforts needed to collect and organize data.

Detailed insights into client interaction are available through email open rates, content engagement, and repeat purchases. Through HubSpot’s customer lifecycle stages, your agency can monitor how clients progress and where retention actions are most needed.

HubSpot has tools for tracking the performance of email marketing campaigns, social media efforts, and lead nurturing campaigns. You can track open rates, click rates, and conversion rates to assess the overall impact of your agency’s marketing efforts.

Thanks to integrations with accounting and invoicing tools, HubSpot allows you to automate the tracking of financial metrics, reduce manual entry, and help update financial records tied to marketing activities.

Whatagraph

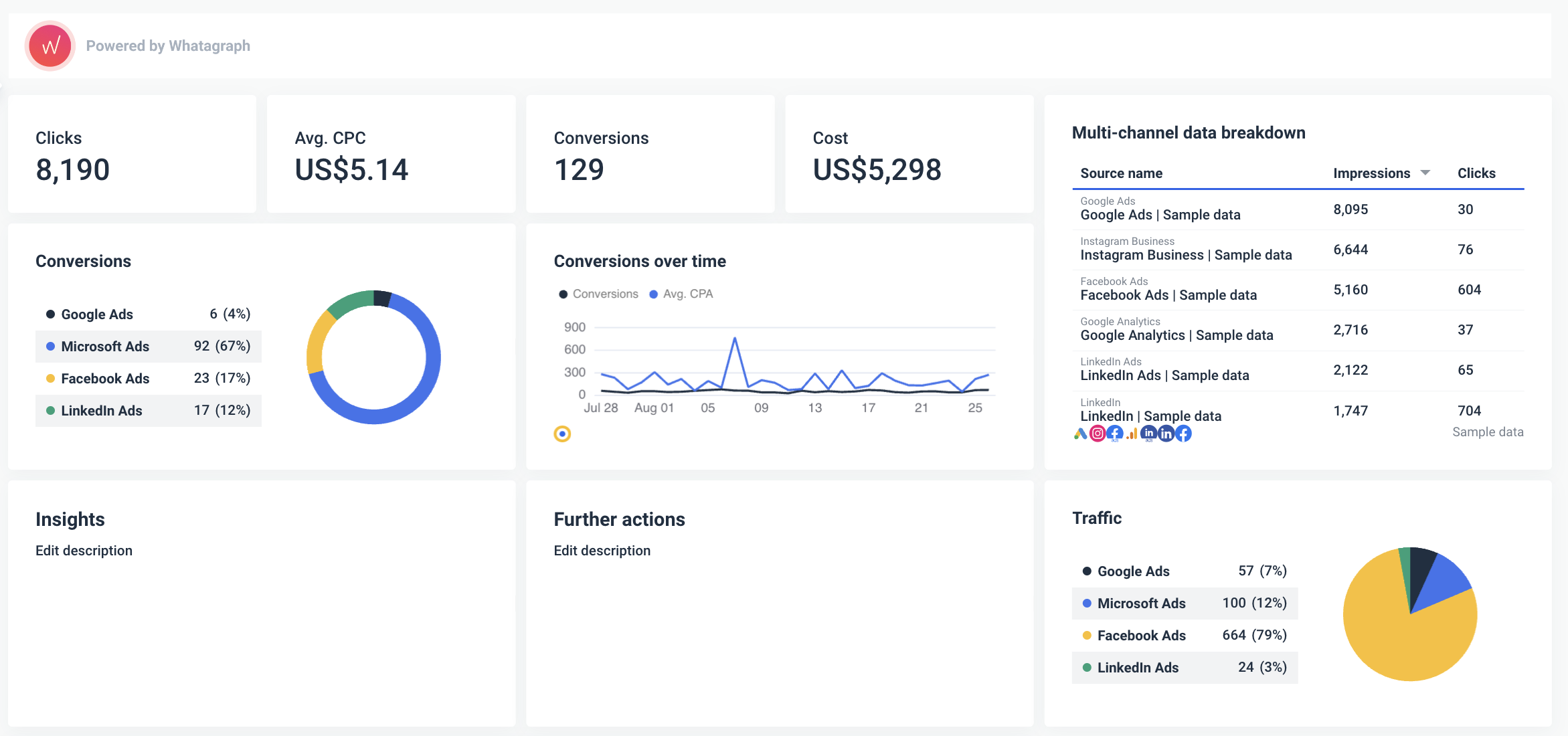

Whatagraph simplifies the process of reporting on user acquisition and campaign performance metrics by consolidating data from various scattered sources like Google Analytics 4, HubSpot, or PPC platforms into visually appealing reports for clients.

Its automated reporting feature allows agencies to schedule regular reports with acquisition metrics from different platforms, saving time on manual data collection and report building. Using ready-made report templates, agencies can effortlessly aggregate campaign performance data from multiple platforms into clear, user-friendly reports and track metrics such as ad performance, social media engagement, and email campaign metrics.

Bottom line

By focusing on the right data points, agencies can not only track their performance but also uncover actionable insights that drive growth, improve client satisfaction, and increase profitability.

The key is to prioritize the metrics that align with your agency's specific goals — whether it’s client acquisition, retention, campaign performance, or financial health. A clear understanding of these metrics, combined with regular review and timely adjustments, gives your agency an edge over the competition.

Remember, it’s not about tracking everything — it’s about tracking marketing agency KPIs that matter most and doing it in a time-saving way.

Try our agency dashboard, which has everything you need to monitor the essential agency metrics — both the high-level KPI goals and specific acquisition, retention, or other agency performance metrics.

WRITTEN BY

Nikola GemesNikola is a content marketer at Whatagraph with extensive writing experience in SaaS and tech niches. With a background in content management apps and composable architectures, it's his job to educate readers about the latest developments in the world of marketing data, data warehousing, headless architectures, and federated content platforms.