CAC payback: how to shorten the period and start making money immediately

Here's your one-stop shop for everything you need to know about CAC payback periods, formulas, and how to create projects with higher returns. Learn how to shorten the payback period and find tips for your next sales and marketing strategy. You won't need to read another article about the CAC payback period, we guarantee it

Sep 03 2021●9 min read

You don't always get the value of something you buy right away in life. Whether you're investing in vitamins, a gym membership, education, or even coffee, the real value will show up in hours, days, or years. This concept is very similar to when businesses acquire customers who are rarely profitable from the start.

The majority of the time, sales and marketing teams invest a significant amount of money in the acquisition, only for the chance to profit from those specific customers in the future. And it goes without saying that recouping your entire investment takes time. In other words, if you want to start making money, this payback period is critical to your business.

CAC payback quick-guide

Payback period - the amount of time it takes for a customer's acquisition costs to be recouped.

CAC payback period formula -

CAC - average customer acquisition cost

MRR - average monthly recurring revenue

ACS - average cost of service

Why is it important - To assess efficiency. That is to say if your customer payback period is short, you were extremely efficient in acquiring those customers. However, a long payback period indicates that the investment will take some time to recover.

What is a good CAC payback period - Many experts say that 12 months or less is a proper period.

However, this isn't a universal truth. It's essentially a comparison game. You'll want to take a broad look at it and compare different cohorts and channels. Find out how much you're spending on these customers.

Let’s say your CAC payback period for Google Ads is 6 months, and your total annual cost payback period for organic is 18 months. Then you might want to double down and invest as much money as you can into Google Ads because on Google, you're acquiring more profitable and efficient customers (in the future we will talk about how each channel gets different quality customers). They're the ones you want to make sure are promoting your development.

How to reduce CAC payback period

You will not only cut the CAC payback period in half if you follow the principles outlined below, but you will also begin making money right away.

1. Monetize your customers.

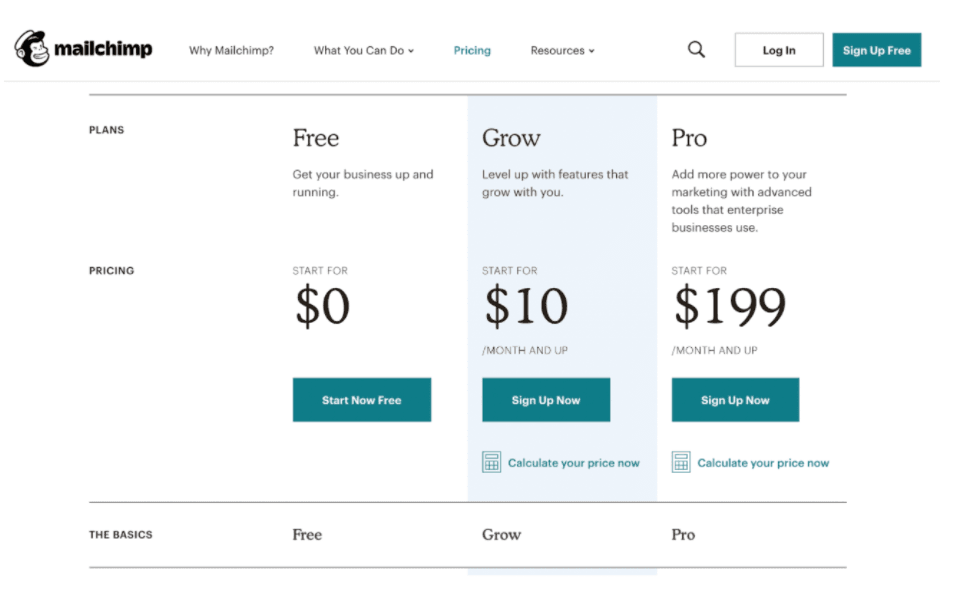

Like email marketing company MailChimp, provide a scalable solution. The company promotes its pricing strategy as having “flexible plans that grow with you”. Their plans start at $10 per month, but the price varies depending on the number of contacts on the customer's email list. MailChimp's monthly revenue increases in synch with their customer email list. This is brilliant!

2. Use a self-service model.

Atlassian is one of those companies that has managed to provide the right product to meet the needs of a particular audience. They save money on sales and marketing simply by achieving product/market fit. This overall process aids in the reduction of sales and marketing spend, resulting in a lower CAC and a shorter payback period.

3. Experiment with your pricing.

There is no way to predict what prices will be most effective in providing the best value match for customers. Remember that you must also ensure that your company grows and operates efficiently.

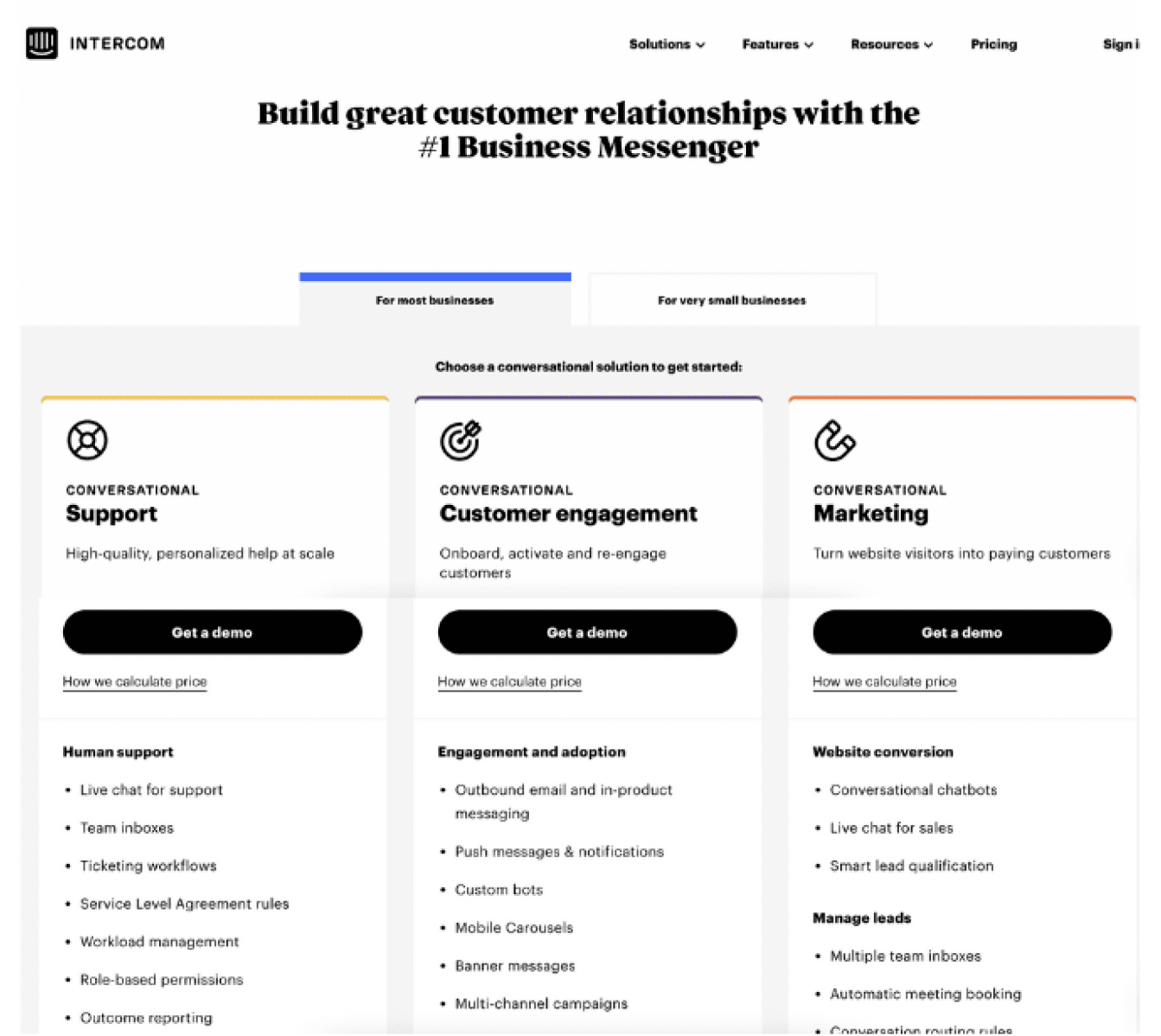

What Intercom does is fairly standard these days. They chose not to display their pricing in order to find the right amount of money for the client. It also helps the company to find out what works best and which prices are more acceptable in the market. Only by having this data could they decide what prices to display on the website. This method is not only effective and efficient. If done right, it can also be very profitable.

4. Increase your reliance on your least expensive acquisition channels.

Determine where the majority of your high-quality leads come from. Evaluate where the least expensive, high-quality leads are coming from and double down on those to reduce CAC and CAC payback.

5. Promote annual subscriptions or plans.

It all boils down to your pricing models and how your customers pay you, whether it's through an annual subscription, scaled pricing, or a monthly fee. It goes without saying that higher upfront client costs will help CAC expenses be recovered more quickly. So, don’t be shy to promote your most expensive plans more frequently than your less expensive ones. Just remember to add value!

Befriend these metrics

These 3 metrics will provide you with a comprehensive picture of your sales efficiency and business progress. These KPIs are useful to understand because they are directly related to the process of reducing the CAC payback period.

- Track average revenue per user (ARPU) to see how much you earn from each customer. If you find out your best customer acquisition channels and understand your month-to-month expenditure of your paying clients, you can then make data-driven decisions and build strategies on them.

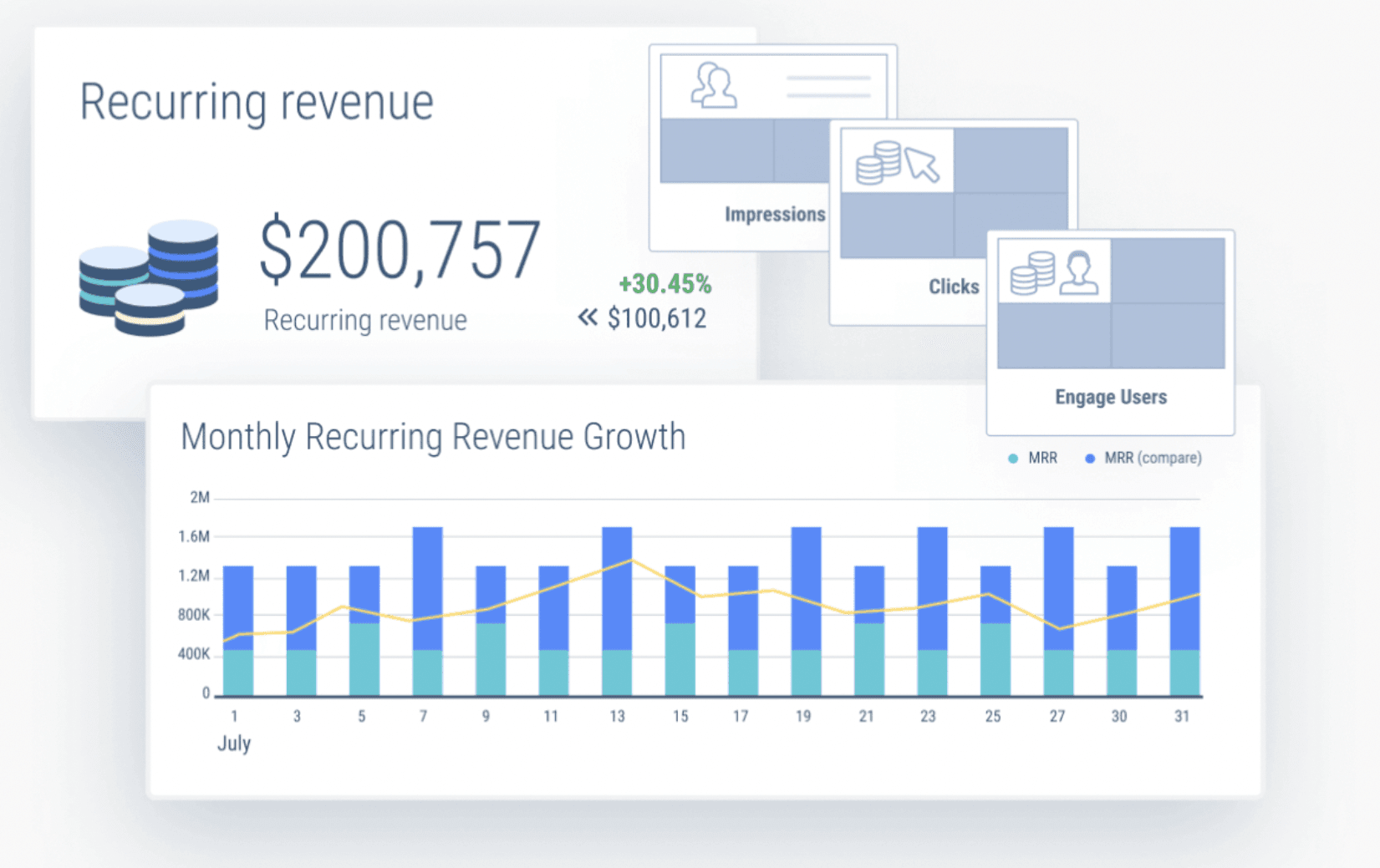

- Monthly recurring revenue growth

Monitoring revenue growth is critical for understanding and learning how profitable your company is. This KPI measures your ability to convert sales into profit.

Calculate your rises and falls; Examine your business and its financial statements; Find patterns and causes of revenue decreases. Only after a sufficient amount of data has been gathered should new revenue drivers be considered.

3. Cost per acquisition

To shorten the CAC payback period or increase profit, you must first understand how much it costs to acquire a single customer.

Find a good analytics tool to assist you in tracking the most profitable and least expensive channels from which your customers are coming. Decide which channels require additional investment and which do not. Not only will you find places to save money, but you will also learn more about your customers and target audience.

Final note

The one thing we didn't cover is why acquiring new customers can help shorten the payback period. It's just that it's very industry-dependent and there is no one-size-fits-all solution. What you should do next is improve your acquisition strategies and monetize your existing customers. This will almost certainly assist you in putting your company on the fast track to success.

Tracking important KPIs with Whatagraph is both simple and visually appealing. Keep an eye on your sales, advertising performance, conversion rate, and revenue. Now is the time to use an analytics tool to help you increase your SaaS score.

WRITTEN BY

Dominyka VaičiūnaitėDominyka is a copywriter at Whatagraph with a background in product marketing and customer success. Her degree in Mass Communications/Media Studies helps her to use simple words to explain complex ideas. In addition to adding value to our landing pages, you can find her name behind numerous product releases, in-app notifications, and guides in our help center.