7 Key SaaS Metrics to Track

A SaaS business model is more complex than the traditional business model. The business metrics in the conventional business model rarely factor in key saas metrics that influence performance.

Mar 29 2020●3 min read

What Is the Importance of KPIs?

Regardless of your niche or industry - customer success, marketing, sales, or anything else, there is always data to track. For most businesses, they must visualize their KPIs without the hassle. KPIs can help you know what is working and what is not.

The only challenge is you need to know which KPIs to track. If you are just starting and you are checking out some metrics, you may make the mistake that you'd need to monitor every KPI you come across. That's not a good idea, and it may not yield results.

KPIs vs. Metrics: Are They the Same?

KPIs and metrics are two different things. KPIs are values you can measure that indicates how effective you are actualizing your business goals. Metrics on the other hand track the status of a particular business process.

KPIs track if you achieve business targets while metrics track the process.

In this article, you will be able to answer these questions:

- Can my business boost of financial viability?

- What works, and what needs to be tweaked?

- What can we focus on to drive performance?

- Should the board of directors hit the brakes or the accelerator?

- What is the cash flow impact of hitting the accelerator?

- What are good metrics to track?

What Makes SaaS Business Stand Out?

SaaS businesses are unique as they generate revenue over an extended timeframe. If any of your customers are happy with the solution, they will remain for a long time, and the profit that will accrue from that customer will continue to increase.

Likewise, if a customer does not derive value from the solution, he or she will churn quickly, and you will most likely lose ROI generated to acquire that client. ROI is dependent on the number of users retained. Improve your product adoption model, and activate, and retain more users. Increase your customer lifetime value and revenue.

This is fundamentally a different ball game when contrasted to a traditional software business model.

Acquire customers

You need to keep your customer to maximize the lifetime value. Based on the relevance of customer retention, we will discover several metrics that enable us to appreciate churn and retention.

The fastest developing SaaS businesses track metrics that count. So what are those vital metrics that are relevant to help you scale your SaaS business?

What Are Good SaaS Metrics?

1. Net MRR Growth Rate

Net MRR Growth Rate is one of the key saas metrics you need to track as it indicates how fast your SaaS business is growing.

It is also called Net Monthly Recurring Revenue Growth Rate.

It estimates the percentage increase in net MRR from month to month. This metric is one of the crucial and common SaaS metrics. The MRR changes as your business add additional revenue and customer churns.

The growth rate indicates the net disparity of those parameters every month. The net growth rate shows a formidable indicator of how quickly your SaaS business is growing. Your ability to minimize monthly churn while you boost monthly revenue is a reliable indicator to track in business.

2. Net MRR Churn Rate

Nothing drains the life out of your business as an MRR churn. You must be diligent in bringing down your MRR churn to zero as much as possible, or better still main a negative churn.

What is Net MRR Churn Rate?

It's the estimation of loss revenue monthly as a result of account downgrades and cancellations, having factored all revenues generated from expansion or upgrades. It indicates revenue churn less expansion or revenue added. This is the opposite of Gross MRR Churn Rate that factors only the total loss to your business while excluding expansion.

3. Gross MRR Churn Rate

Also known as Gross Monthly Recurring Revenue Churn Rate. This is the total percentage of revenue you lost as a result of downgrades or cancellations. It is the estimation of the total loss to your company against the Net Churn Rate, which estimates the relative loss having subtracted your expansion MRR.

This number reveals the health of your SaaS business.

The inverse of this SaaS metric is the Gross MRR retention Rate. This rate focuses on the retained revenue on a month-to-month basis.

You can always improve your Net MRR by expanding or new logos. However, if the Gross MRR churn rate goes below 1-2 percent, it means something is wrong with your product.

4. Expansion MRR Rate

The Metric Expansion MRR or Monthly Recurring Revenue is the extra revenue you've generated from existing clients via upsells, cross-sells, or add-ons.

Expansion MRR connotes the ability of your SaaS business to deliver more value to your customers and also monetize the value. It is highly essential to be able to generation expansion MRR. A lot of the top-notch later stage SaaS enterprises secure a sizable proportion of their growth from existing clients.

5. Average Revenue Per Account or ARPA

ARPA or Average Revenue Per Account is the revenue you've generated per account. It is usually estimated on either a monthly or a yearly basis. It is often referred to as the Average Revenue per User or ARPU or the Average Revenue Per Customer or ARPC. In some SaaS businesses, a customer may have more than one account. Thus, these customer-based parameters can differ from ARPA.

It is highly important to check this out from the new clients acquired in the month. You can plot a trendline to indicate the average price point selected by your new customers.

6. Lead Velocity Rate

Lead Velocity Rate or LVR is another key saas metric that estimates the percentage growth of qualified business leads from month to month. It estimates the development of your pipeline. In other words, it seeks to find out the number of potential customers you are aspiring to convert to paying customers.

Lead Velocity Rate is never lagging, and it is real-time. It clearly shows the future of growth and revenues. It is highly crucial strategically than your monthly or quarterly growth as you can visualize the future of your company 12 to 18 months forward.

This opportunity of visualizing your existing pipeline, coupled with the historical development of your pipeline enables you 'guesstimate' or estimate what growth will look like in months to come.

Therefore, the qualified sales pipeline is one of the highly important metrics you will need to track if you are scaling. Using SaaS CRM software helps you to identify new sales opportunities to improve LVR.

7. CAC Payback Period

The SaaS Metric CAC Payback Period refers to the number of months taken to earn back what you've invested in acquiring leads. It reveals your break-even point.

It determines the amount of cash your company needs to grow.

A lot of startups would need about 15 to 18 months to recover the costs they have invested in acquiring new customers. This alone can put a strain on capital. Therefore, try to focus on minimizing the CAC that you need to recover each year.

Why to use Whatagraph?

Lead generation is usually an issue once you delve into digital marketing. It does not matter the types of strategy you leverage to generate traffic. If that traffic fails to produce quality leads, it is useless. Therefore, there are several key saas metrics you need to check to test the productivity of your online traffic.

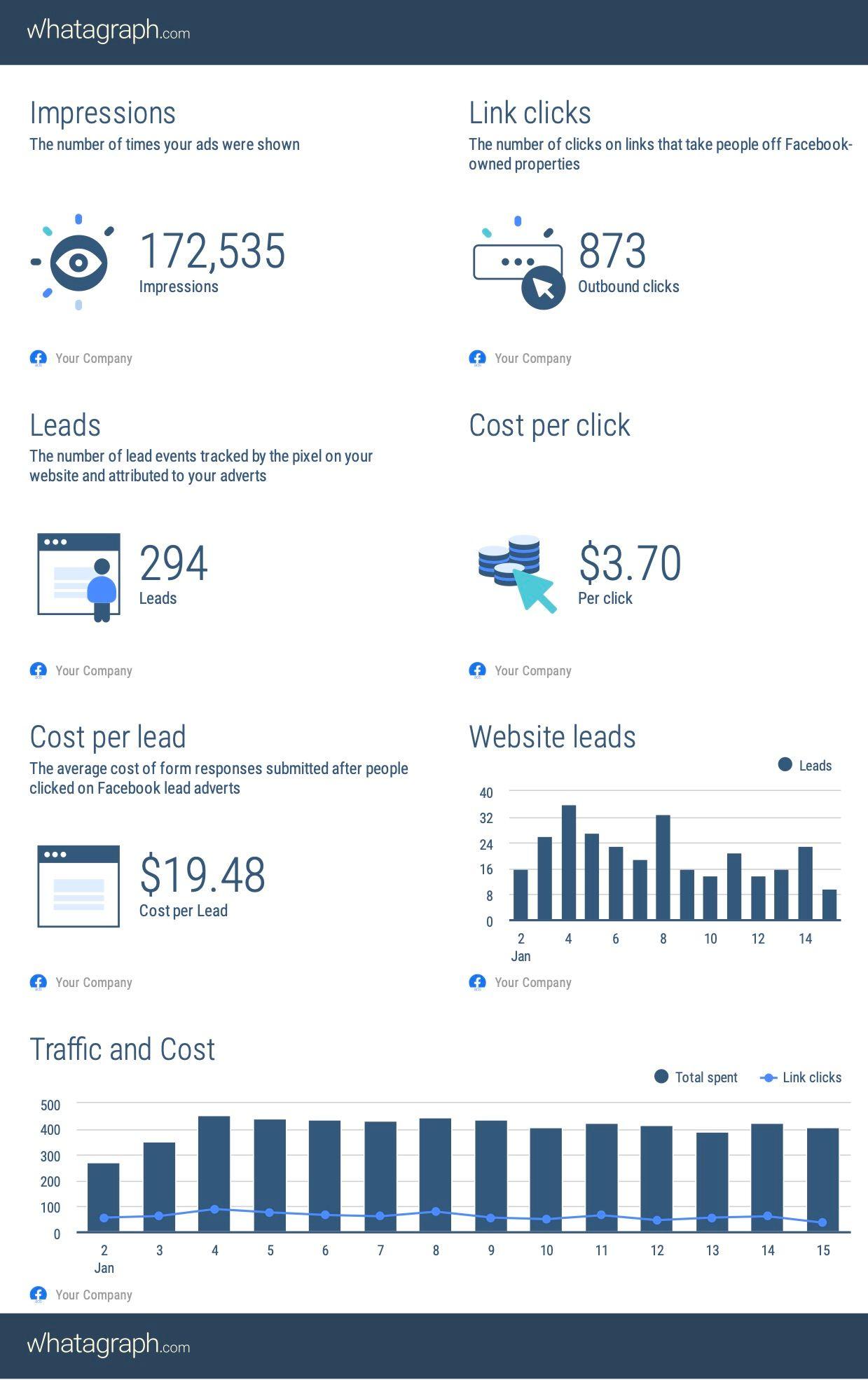

Whatagraph integrates over 40 tools in a bid to supply you data. The tool is designed to provide you information that you can easily understand and digest. With Whatagraph - SaaS Analytics and Automated SaaS Reports, you can track your channels and confirm which of them is bringing you leads.

WRITTEN BY

Indrė Jankutė-CarmaciuIndrė is a copywriter at Whatagraph with extensive experience in search engine optimization and public relations. She holds a degree in International Relations, while her professional background includes different marketing and advertising niches. She manages to merge marketing strategy and public speaking while educating readers on how to automate their businesses.